Leveraging the Florida Small Business Emergency Bridge Loan Program for Post-Hurricane Recovery

April 30, 2024

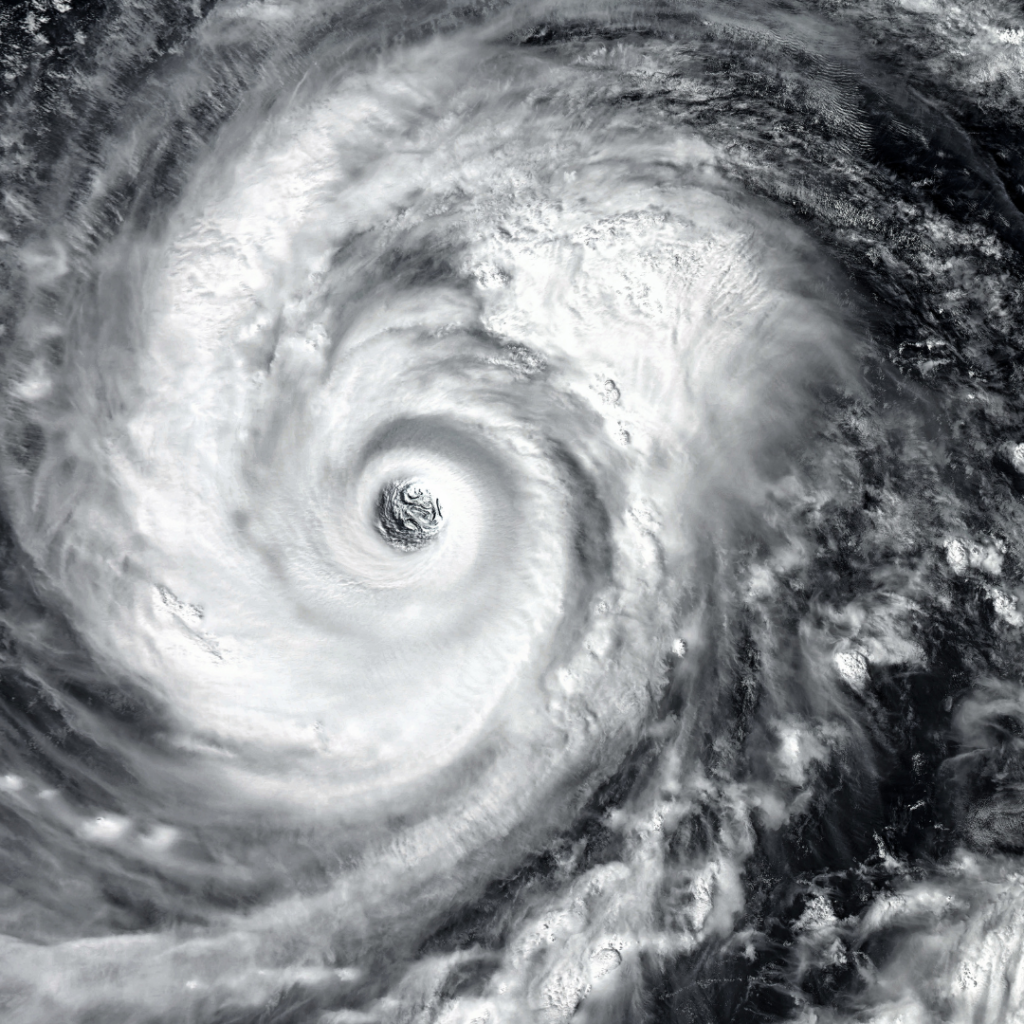

As hurricane season approaches, it's essential for businesses to prepare for potential disruptions and ensure they have access to financial resources in the event of a disaster. The Florida Small Business Emergency Bridge Loan (EBL) program offers a lifeline for businesses impacted by hurricanes, providing short-term, zero-interest working capital loans to bridge the gap until longer-term recovery funding becomes available. In this article, we'll explore how local businesses can utilize the EBL program to navigate the challenges of post-hurricane recovery.

Understanding the Florida Small Business Emergency Bridge Loan Program:

Managed by FloridaCommerce, the EBL program is designed to provide immediate financial assistance to businesses affected by disasters. Here's an overview of key program details:

-

Loan Amount and Terms: Eligible businesses can receive loans of up to $50,000 with a one-year term. These loans are short-term, personal loans using state funds and must be repaid.

-

Eligibility Requirements: To qualify for the EBL program, businesses must meet specific criteria, including being located in Florida, having been established prior to a certain date, being located in county impacted by a natural disaster (as designated by the Governor’s office), and employing two to 100 employees. Additionally, applicants must have a credit score of 600 or above.

-

Application Process: Businesses can apply for the EBL program online through FloridaCommerce. The application requires various documents, including tax returns, proof of employment, and a voided check.

How Businesses Can Benefit After a Hurricane:

In the aftermath of a hurricane, businesses often face financial challenges due to property damage, supply chain disruptions, and lost revenue. The EBL program can provide critical support during this period by offering immediate access to working capital. Here are some ways businesses can leverage the program:

-

Covering Immediate Expenses: EBL funds can be used to cover essential expenses such as payroll, rent, utilities, and inventory replacement, helping businesses stay operational during the recovery process.

-

Filling Funding Gaps: While businesses may have insurance coverage or access to other forms of assistance, there can be delays in receiving these funds. The EBL program fills the gap by providing quick access to capital, ensuring businesses have the resources they need to rebuild and recover.

-

Avoiding Long-Term Debt: Unlike traditional loans, EBLs offer zero-interest financing for a limited period. This allows businesses to address immediate needs without taking on long-term debt, ultimately easing the financial burden of recovery.

Preparing for Hurricane Season:

With hurricane season starting on June 1st, it's crucial for businesses to proactively prepare for potential disasters. Here are some steps businesses can take to ensure they're ready:

-

Review Emergency Plans: Update and review your business's emergency preparedness plan, including evacuation procedures, communication protocols, and contingency measures for continued operations.

-

Secure Important Documents: Keep essential documents such as insurance policies, financial records, and employee information in a secure, accessible location to facilitate the claims process and ensure continuity of operations.

-

Stay Informed: Monitor weather forecasts and official updates from local authorities to stay informed about potential threats and evacuation orders. Sign up for emergency alerts and notifications to receive real-time information.

-

Explore Financial Assistance: Familiarize yourself with available resources, including the EBL program, and understand the application process to expedite access to funding in the event of a disaster.

As businesses prepare for hurricane season, the Florida Small Business Emergency Bridge Loan program serves as a valuable resource for securing short-term financing to support recovery efforts. By understanding the program's eligibility criteria, application process, and benefits, businesses can better prepare for and navigate the challenges of post-disaster recovery. Stay informed, stay prepared, and remember that assistance is available when you need it most. For connections to resource partners who can assist in the application process fill out the form below.