Understanding Foreign-Trade Zone 193: An Overview and How-To Guide

May 6, 2025

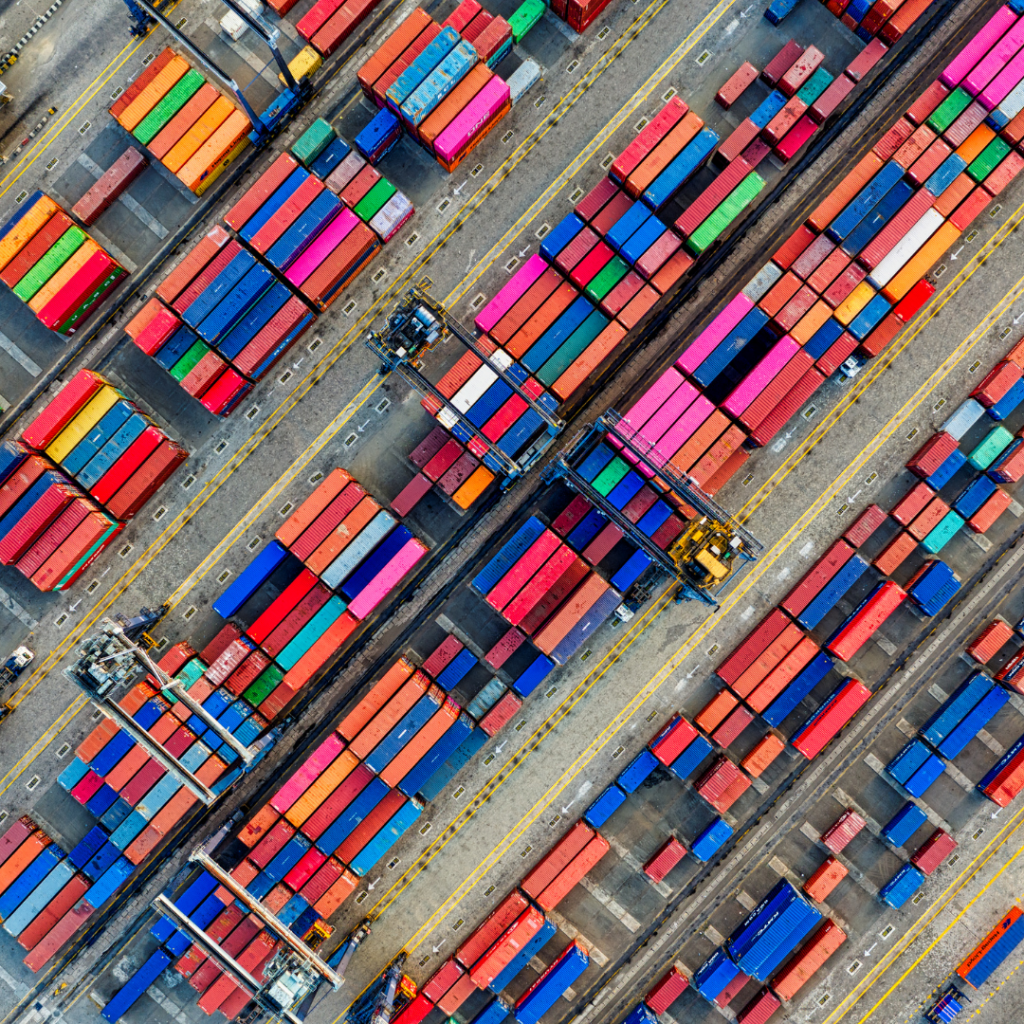

Foreign-Trade Zone 193 gives Pasco County businesses a powerful way to reduce import duties, simplify customs procedures and improve cash flow. This guide explains what an FTZ is, highlights the advantages of Zone 193 and walks you through the steps to leverage it for your company.

What Is a Foreign-Trade Zone?

A Foreign-Trade Zone is a secured area designated by U.S. Customs and Border Protection where imported goods can be stored, processed or manufactured without formal customs entry or payment of duties until they enter U.S. commerce. Exports from the zone never incur U.S. duties.

Key Benefits of Zone 193

-

Duty Deferral

-

Pay duties only when goods leave the zone for domestic use, improving your working capital.

-

-

Duty Elimination

-

If you import parts that are assembled or manufactured into an export product, you pay no duties on those inputs.

-

-

Inverted Tariff Rates

-

When the finished product’s tariff rate is lower than its component rates, you pay the lower rate.

-

-

Reduced Entry Fees

-

File weekly or monthly entries rather than daily, cutting paperwork and entry fees.

-

-

Flexible Storage

-

Store goods indefinitely in bond, deferring duties until you need them.

-

Why Choose Zone 193?

-

Strategic Pasco Location

-

Easy access to Interstate 75, the Port of Tampa and major rail lines makes inbound and outbound logistics efficient.

-

-

Local Support Network

-

Pasco County economic development staff partner with CBP and local operators to guide you through site selection, application and compliance.

-

-

Versatile Operations

-

Zone 193 accommodates warehousing, light assembly, kitting, testing and packaging.

-

How to Qualify and Apply

-

Evaluate Your Duty Savings

-

Identify your highest-cost imported inputs and estimate potential savings under an FTZ model.

-

-

Pick a Site or Operator

-

Choose an existing zone operator within Zone 193 or apply to become a subzone operator for custom infrastructure.

-

-

Gather Your Application Materials

-

A brief business plan with projected throughput and savings estimates

-

A site diagram showing secure boundaries, storage and processing areas

-

A security plan that meets CBP requirements

-

-

Submit to the Foreign-Trade Zones Board and CBP

-

Pasco County staff can review your application before submission. Expect 60 to 90 days for approval.

-

-

Activate and Operate

-

Coordinate with CBP to activate your zone status. You can then admit, process and distribute goods under FTZ rules.

-

Best Practices for Ongoing Compliance

-

Accurate Record-Keeping

-

Maintain detailed inventory ledgers and movement logs for CBP audits.

-

-

Annual Reviews

-

Reassess duty savings and operational needs each year to ensure continued value.

-

-

Partner Consultations

-

Use Pasco County’s advisory services or third-party experts for periodic compliance checks.

-

Next Steps

Ready to explore your own duty-savings scenarios more in depth? Provide your information below to receive a link to the latest Duty Savings Estimator Worksheet from Trade.gov so you can test multiple inputs, duty rates and finished-goods scenarios for your business. Feel free to reach out with any questions about how to best leverage FTZ 193.